Having a good credit score is essential for achieving financial stability and success. A poor credit score can prevent you from getting approved for loans, credit cards, and even renting an apartment. If you are struggling to improve your credit score on your own, it may be time to consider hiring a credit repair service.

Credit repair services are companies that specialize in helping individuals repair and improve their credit scores. These services work with credit bureaus, creditors, and collection agencies to remove negative items from your credit report and help you establish better credit habits.

When looking for the best credit repair service, it is important to do your research and choose a reputable company that has a proven track record of success. Here are some tips on how to repair your credit to find the best credit repair services:

- Check for accreditation: When researching credit repair services, look for companies that are accredited by organizations such as the Better Business Bureau (BBB) or the National Association of Credit Services Organizations (NACSO). Accreditation shows that the company has met certain standards of quality and professionalism.

- Look for reviews and testimonials: Reading reviews and testimonials from past clients can give you insight into the effectiveness of a credit repair service. Look for reviews on independent review websites and consumer advocacy websites to get a better understanding of the company’s reputation.

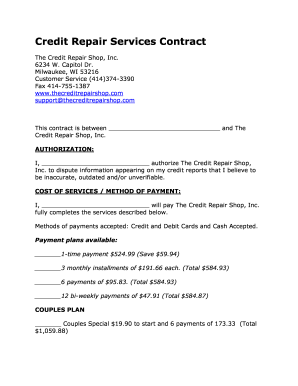

- Ask about fees and services: Before choosing a credit repair service, make sure to ask about their fees and the services they offer. Some companies charge a one-time fee, while others charge a monthly fee for ongoing services. Make sure you understand exactly what services are included in the fee and what you can expect from the company.

- Verify their credentials: Before hiring a credit repair service, verify their credentials and qualifications. Make sure the company has certified credit repair specialists who are knowledgeable about credit laws and regulations.

- Get a free consultation: Many credit repair services offer free consultations to assess your credit situation and recommend a plan of action. Take advantage of these consultations to see if the company is a good fit for your needs.

Some of the best credit repair services include Lexington Law, CreditRepair.com, and Sky Blue Credit Repair. These companies have a proven track record of success and have helped thousands of clients improve their credit scores.

Improving your credit score can take time and patience, but with the help of a reputable credit repair service, you can take the first steps towards financial freedom and stability. By doing your research, asking the right questions, and choosing a reputable company, you can find the best credit repair service to help you achieve your credit goals.

When looking for a credit repair service, it’s important to do your research and choose a company that is reputable, transparent, and has a track record of success. Look for companies that offer a free consultation, so you can discuss your credit situation and get a sense of how they can help you. Be wary of companies that make promises that sound too good to be true, as there are no guarantees when it comes to

When looking for a credit repair service, it’s important to do your research and choose a company that is reputable, transparent, and has a track record of success. Look for companies that offer a free consultation, so you can discuss your credit situation and get a sense of how they can help you. Be wary of companies that make promises that sound too good to be true, as there are no guarantees when it comes to  Why are step-by-step guides important?

Why are step-by-step guides important? Another effective credit repair strategy is to become an authorized user on someone else’s credit card account. By being added as an authorized user, you can benefit from the primary cardholder’s positive credit history and potentially boost your credit score. However, it is essential to choose someone who has a good

Another effective credit repair strategy is to become an authorized user on someone else’s credit card account. By being added as an authorized user, you can benefit from the primary cardholder’s positive credit history and potentially boost your credit score. However, it is essential to choose someone who has a good  Ultimately, a healthy credit score is a key component of financial success. By utilizing the resources and advice provided on Our Credit Repair Blog, you can become more knowledgeable about credit repair and maintenance, and take the necessary steps to improve your credit score. Whether you are looking to buy a home, finance a car, or simply improve your overall financial well-being, our blog is here to help you achieve your goals. So why wait? Start your journey to a healthier credit score today with Our Credit Repair Blog.

Ultimately, a healthy credit score is a key component of financial success. By utilizing the resources and advice provided on Our Credit Repair Blog, you can become more knowledgeable about credit repair and maintenance, and take the necessary steps to improve your credit score. Whether you are looking to buy a home, finance a car, or simply improve your overall financial well-being, our blog is here to help you achieve your goals. So why wait? Start your journey to a healthier credit score today with Our Credit Repair Blog. The first step in repairing your credit is to check your credit report. You are entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months. Review your credit report carefully and look for any errors or inaccuracies. If you find any errors, you should dispute them with the credit bureau to have them corrected.

The first step in repairing your credit is to check your credit report. You are entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months. Review your credit report carefully and look for any errors or inaccuracies. If you find any errors, you should dispute them with the credit bureau to have them corrected.